That way, borrowers don’t have to worry about insurance updates and payment processes. To start your insurance policy management system, you will need to access and update your credit information on the MyCoverageInfo portal. Hopefully, you will learn more about how the process works, and it will provide additional information you may find valuable.

The portal is designed to bring together all your credit and insurance policies in one place and provide you with an active management system. This minimizes the financial burden and helps customers distribute their loan payments heavenly. The service is especially useful when you pay multiple loans and insurance payments over time.

The process used by MyCoverageInfo to track your insurance policy is quite simple. When customers buy a property, they can apply for a home loan and purchase home insurance. Along with your credit information, the MyCoverageInfo portal receives your insurance information.

Login For My Coverage Info

The MyCoverageInfo portal allows you to update your credit information and insurance details. Once updated, the portal will follow the evolution of your insurance policy and inform the policy m the insured or the intermediary if necessary.

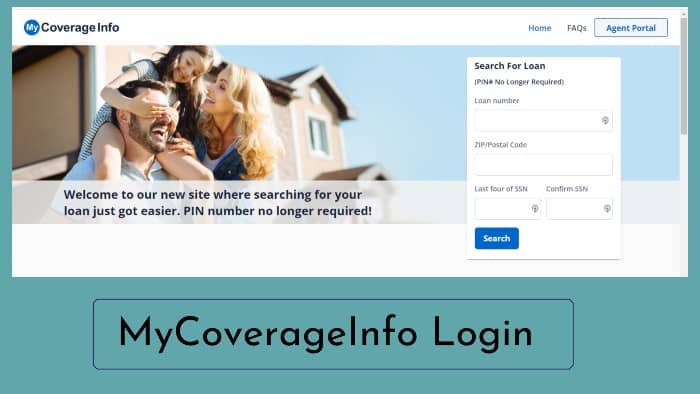

- You must first open the web browser on your device and navigate to the login at mci3.mycoverageinfo.com.

- Enter the pin code

- Then continue with the connection process.

- Now enter your valid password.

- And access your MyCoverageInfo information.

Login Requirements

- It would be best to have your laptop, desktop, or smartphone access the official portal.

- If you’re having connection problems, ensure your internet connection is stable.

- We recommend accessing the www.MyCoverageInfo.com portal using a recommended browser such as Google Chrome, Safari, Firefox, or Microsoft Edge.

- To find your loan and access your insurance details, you will need your loan number, your zip code, and your SSN (social security number).

What is www.MyCoverageInfo.com?

MyCoverageInfo (My Coverage Info) provides customers with the most reliable insurance services to help them secure their future. It is also the safest way to view, modify and purchase a new insurance policy in the safest possible environment. Anyone can use MyCoverageInfo, and it’s pretty simple.

MyCoverageInfo Provides personal, professional, and business social security coverage for Williamsburg, Virginia, and its surrounding areas. Workers’ compensation programs are also available. We offer fast and professional service in auto, residential, business, and life insurance according to the needs of our clients.

Our mission is to provide advice and products that help our clients manage the most important assets in their lives: their homes, their cars, their businesses, their investments. We at Coverage, Inc. strive to build long-lasting relationships with our clients and meet their financial needs throughout their lives. “He has served hundreds of clients and is committed to treating each client with respect and compassion.”

Benefits of MyCoverageInfo.com

MyCoverageInfo.com gives registered members access to their financial hedge accounts. And after logging into your account, people can see the current status of insurance policies and current and outstanding loans.

Additionally, MyCoverageInfo.com is the safest way to check policy information and loan information. Creating an account on My Coverage Information is simple and allows you to check the status of your policies and loans at any time.

Furthermore, www.MyCoverageInfo.com websites aid you further in getting a claim approved and dealing with the insurance provider. Through the MyCoverageInfo portal, you will update the information regarding your loans and insurance policies.

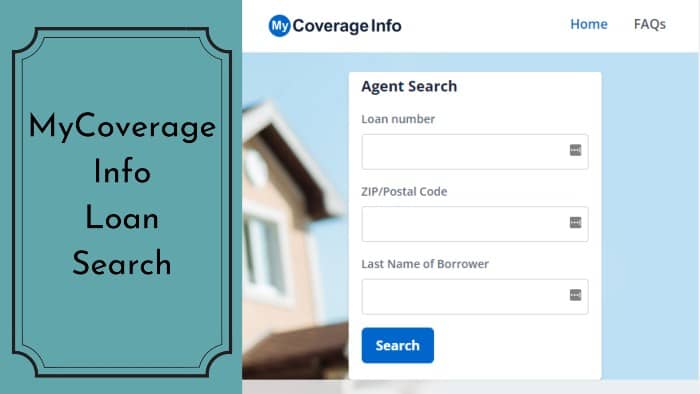

How To Search For Your Loan At MyCoverageInfo?

MyCoverageInfo also helps with claiming and dealing with the insurance provider. The MyCoverageInfo portal allows you to MyCoverageInfo portal enables you to update your credit information and your insurance policy details. Once updated, the portal will follow the evolution of your insurance policy and inform the insured or the intermediary if necessary. To find your loan and update your insurance information, follow these easy steps to continue.

- To find your credit, visit the official portal at www.MyCoverageInfo.com.

- On the MyCoverageInfo homepage, you will find the “Find a loan” section on the right side of the page.

- The loan number must be entered in the provided field, not your PIN code. You can find your credit number on your credit application or your monthly statement.

- Please enter the zip code that your credit document is linked to it.

- Enter the last four digits of your SSN (social security number).

- Enter the four digits again to confirm submission.

- Click the Search button to enter and update your policy information.

- By logging into your MyCoverageInfo account, you can update your agent details, insurance information, personal information, credit information, and more so that your insurance policy is automatically monitored.

- Update your credit information as well as your insurance policy details.

| Official Name | MyCoverageInfo |

|---|---|

| Type of Service | Policy and insurance Provider |

| Portal Type | Login |

| Origin Country | U.S.A. |

| Languages Supported | English |

Troubleshooting Common Portal Issues

Here are the most common problems you may encounter when accessing your MyCoverageInfo account. If you experience any issues, follow the troubleshooting steps outlined in this document. Let’s see some of them:

- When accessing their account, the most common mistake someone makes is entering incorrect information. Double-check that the information provided is correct. The credit number is usually found on your credit document. Not to be confused with the order reference number.

- Sometimes you may be using a browser that is incompatible with the MyCoverageInfo portal. In this case, the portal may not load properly, and you will have some issues. To avoid this, try to access the portal using supported browsers such as Google Chrome, Firefox, Safari, or Microsoft Edge.

- If you access this portal frequently, your browser may be full of unwanted data from this site. Therefore, difficulties may arise in accessing the portal. Clear your browser’s cache and cookies and try again to resolve this issue.

- We are performing server maintenance on this website. The issue is not with your device. Typically, this happens if you have a website that requires care and updates from time to time. After you experience this, wait a few hours and try again.

- You may try the anonymous/private version of the site if you continue to have trouble accessing the site after you have followed the troubleshooting steps. Generally, this provides a workaround.

Customer Service

Mr. Cooper is a movement rather than a brand. The following coverage is included in our new policy. Whether you’re looking for a loan, refinancing, or help to manage an existing loan, we strive to be the friendly, most trusted attorney you’re ever going to meet.

Your satisfaction with Mr cooper Mortgage Customer Service is our top priority. This is due to the fact that they keep things simple, they keep their products simple, and they focus on solutions only. Certainly, we have made great strides, but we are not prepared to rest on our laurels. We are all striving to be better every day. We won’t give up until we reach our one goal: making homeownership a reality for each and every client.

Call Mr. Cooper Toll-free at (888) 480-2432

Frequently Asked Questions

Will I be refunded if I cancel my insurance policy that I purchased from the lender?

Unless coverage is terminated, any unused premiums that have been canceled will be refunded and returned to your account. You are responsible for your current policy on the number of days.

How do I scan my insurance documents?

The easiest way to scan your documents is from your mobile device. Access this site with your mobile device, take a photo of your document(s) and upload the image.

Can I submit multiple insurance documents?

Yes, it is possible to submit multiple documents for the same loan. You can do this by downloading from the dashboard as many times as you like. Once all your documents are uploaded, you can preview them one by one to sort them. You can then upload them all together. Could you make sure they are on the same loan?

What is the mortgage clause?

The mortgage lender clause shows that your mortgage lender is protected by the policy outlined in your mortgage agreement. If the mortgage clause in your insurance policy is incorrect, don’t hesitate to contact your insurance agent to correct it and send us a modification.

Conclusion

Are you looking for a loan provider that can offer you zero-rate loans? Do you want to have a personalized home loan or a home loan and crossed credit? If so, stop looking here and there now! Here I decided to help you.

MyCoverageInfo is a freight provider that will help you find the right insurance. My coverage information: Mycoverageinfo gathers all available insurance policies and enables you to find the right insurance coverage for a claim. Good insurance is always critical.

MyCoverageInfo (My Coverage Info) provides customers with the most reliable insurance services to help them secure their future. It is also the safest way to view, modify and purchase a new insurance policy in the safest possible environment. Anyone can use MyCoverageInfo, and it’s pretty simple.